In today’s competitive market, giving customers flexible payment options can make all the difference. Neocuotas is transforming the way businesses approach installment payments, allowing customers to make interest-free purchases over multiple installments. This guide breaks down how Neocuotas works, the benefits it offers, and how businesses can integrate it to increase sales and customer loyalty.

What is Neocuotas?

Neocuotas is an innovative payment solution that provides customers with the option to pay for their purchases over time with interest-free installments. This service helps businesses attract more customers and encourages larger purchases by offering a convenient and flexible way to pay.

Overview of the Concept

At its core, Neocuotas is designed to offer installment plans with zero interest, which means that customers won’t be charged additional fees or interest when they choose to split their payments. For customers, this translates into affordable access to higher-value products without financial strain.

How Neocuotas Differs from Traditional Financing

Unlike credit cards or bank loans that often involve high-interest rates, Neocuotas gives customers the flexibility of installments without the additional cost. It’s a straightforward, no-interest payment plan that provides more transparency and predictability.

Why Neocuotas is Gaining Popularity

Current Trends in Customer Payment Preferences

Modern consumers are increasingly drawn to payment options that align with their financial comfort levels. The appeal of “buy now, pay later” solutions has exploded, as consumers seek to stretch their budgets without accruing debt. Neocuotas stands out by offering interest-free terms, setting it apart from many other financing options.

Advantages for Both Businesses and Customers

For businesses, Neocuotas offers an opportunity to expand their market by attracting customers who might be hesitant to make large purchases upfront. For customers, it provides a secure and manageable way to purchase what they need without feeling financially burdened.

Key Benefits of Neocuotas

Increase Your Average Sales Ticket

A major advantage of Neocuotas is its ability to increase the average sales ticket. By allowing customers to pay over time, businesses can see a rise in their overall sales value.

How Higher Sales Tickets Benefit Businesses

With Neocuotas, customers are more likely to make larger purchases, as they don’t have to pay the full amount immediately. This can significantly boost a business’s revenue, creating more profit potential.

Impact on Customer Spending Habits

Flexible payment options encourage customers to purchase items they may have otherwise deemed too expensive. Over time, this can positively influence spending habits, increasing customer satisfaction and sales.

Offers Flexible Payment Terms

One of Neocuotas’ core offerings is its variety of installment terms. Customers can select from 2, 3, 6, 10, 12, or even 18 installments.

Available Term Options (2, 3, 6, 10, 12, and 18 Installments)

The range of term options lets customers choose the installment plan that best fits their budget. This flexibility is attractive to buyers across income levels and spending preferences.

Customizing Plans to Suit Different Customer Needs

With multiple term options, Neocuotas allows businesses to tailor payment plans for different customer demographics, enhancing the customer experience.

Interest-Free Installments for Customers

A standout feature of Neocuotas is its commitment to providing truly interest-free installments.

How Interest-Free Payments Appeal to Customers

No one likes hidden fees or surprise charges. With Neocuotas, customers know exactly what they’ll pay, with no additional interest, fostering a sense of trust and transparency.

Building Trust Through Transparent Pricing

Interest-free installments encourage repeat purchases and loyalty. Customers appreciate transparency, making them more likely to return for future purchases.

How Neocuotas Works for Businesses

Setting Up Neocuotas

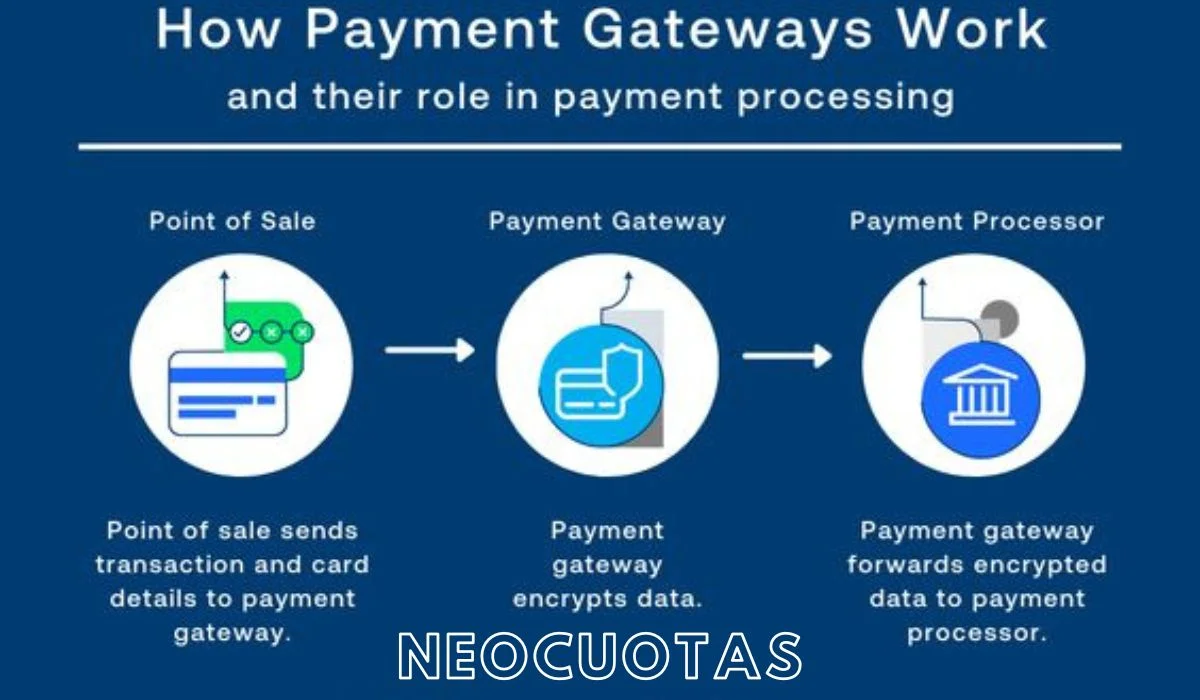

For businesses, setting up Neocuotas is a straightforward process. It requires only a few key steps to integrate the service into their existing systems.

Requirements and Integration Process

The process generally involves minimal setup and doesn’t require significant technical adjustments. Most businesses can incorporate Neocuotas within a few days.

How Businesses Can Start Offering Neocuotas

From initial sign-up to marketing the availability of interest-free installments, businesses can quickly begin using Neocuotas to benefit from increased sales.

Managing Cash Flow with Neocuotas

As with any installment service, cash flow is crucial. Neocuotas provides clear payment schedules, allowing businesses to maintain smooth financial operations.

Payment Schedules and Financial Planning

With predictable payment schedules, businesses can plan their finances effectively and manage any seasonal fluctuations in cash flow.

Handling Large Sales Volumes Smoothly

Neocuotas is built to handle high sales volumes, making it suitable for businesses experiencing growth or seasonal spikes in demand.

How Neocuotas Enhances Customer Loyalty

Creating a Customer-Centric Payment Solution

By prioritizing customer needs with flexible, interest-free payments, Neocuotas fosters strong customer relationships and encourages long-term loyalty.

How Neocuotas Builds Long-Term Relationships

Customers appreciate businesses that make it easy to buy from them, and Neocuotas’ interest-free installments give them a compelling reason to return.

Loyalty Programs and Repeat Purchases

Many businesses use it as part of their loyalty programs, which can further boost repeat purchases and customer engagement.

Industries That Benefit from Neocuotas

Retail Sector

Retailers in fashion, electronics, and more are finding it a valuable tool for increasing sales and attracting new customers.

Application in Electronics, Fashion, and More

From high-end electronics to seasonal fashion collections, it makes it easy for customers to access products that they may have previously considered out of reach.

Healthcare and Wellness

For healthcare providers, it offers a way to help patients manage costly treatments over time.

How Installments Help Patients Manage Costs

In healthcare, payment flexibility can make a difference for patients who need essential care but might struggle with upfront costs.

Service-Based Businesses

From consulting to personal services, any business that offers high-value services can benefit from the payment flexibility of it.

Boosting Sales for Professional Services

It helps service providers capture more clients by offering easy payment terms that make their services accessible to a broader audience.

Common Myths

Myth 1: It’s Too Complicated to Implement

Some businesses hesitate due to perceived complexity, but it is designed to be user-friendly and quick to set up.

Simple Setup Process Explained

Integration is typically fast and easy, with support available for businesses that need it.

Myth 2: It’s Risky for Small Businesses

Many believe installment options pose financial risks, but it provides a secure solution with low risk, even for small businesses.

How Neocuotas Mitigates Financial Risks

It uses secure payment mechanisms to ensure both the business and customer are protected, reducing any associated risks.

Best Practices for Maximizing Success

Promoting the Availability of Installments

Letting customers know that installment options are available can attract more buyers and increase sales.

Training Your Team on Neocuotas Benefits

Employees should understand its benefits so they can effectively communicate them to customers.

Using Customer Feedback to Improve Offerings

Feedback helps businesses refine their offerings and create even better customer experiences.

Conclusion

It offers a practical, customer-centric solution that benefits both businesses and customers. With flexible terms, interest-free payments, and a seamless setup process, it can enhance sales, build loyalty, and drive growth for businesses of all sizes.

FAQs

- What types of businesses can use Neocuotas?

Any business that sells products or services can benefit from offering installment options through it. - How does Neocuotas compare to credit card financing?

Unlike credit card financing, it doesn’t charge interest, making it a more affordable option for customers. - Are there any hidden fees associated with Neocuotas?

It prides itself on transparency; customers only pay the purchase price divided across installments. - How quickly can a business start using Neocuotas?

Most businesses can set up and start using it within a few days. - Can customers choose their installment terms?

Yes, customers have a range of term options to choose from, depending on their needs and budget.